do you have to pay inheritance tax in arkansas

An attorney can tell you about the benefits of a living trust or other legal tools which may reduce the size of the estate that has to go through probate. Although there is no Arkansas estate tax or inheritance tax beneficiaries may have to pay federal tax on money they receive.

Individual Income Tax Arkansas Department Of Finance And

Essex Ct Pizza Restaurants.

. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Arkansas does not have an inheritance tax.

Income Tax Rate Indonesia. They must be followed to ensure the estate is distributed as required by law. Inheritances that fall below these exemption amounts arent subject to the tax.

Surviving spouses are always exempt. Arkansas does not have an inheritance or estate tax. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022.

State rules usually include thresholds of value. Do You Have To Pay Inheritance Tax In Arkansas. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Opry Mills Breakfast Restaurants. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Very few people now have to pay these taxes.

Delivery Spanish Fork Restaurants. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. The state in which you reside.

States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state.

Soldier For Life Fort Campbell. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. You would receive 950000.

Your relationship with the deceased. Settling an Estate in Arkansas. Arkansas does not collect inheritance tax.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in. The amount of inheritance tax that you will have to pay depends on.

The estate would pay 50000 5 in estate taxes. Many of the steps for probate in Arkansas are the same as in other states. You would pay 95000 10 in inheritance taxes.

However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax. As of 2012 nine states imposed an inheritance tax. The percentage can range from 0 to 18 and there may be different rates for different types of property.

The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. The maximum tax rate ranged from 95 percent in Tennessee to 18 percent in Maryland. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you.

Having a knowledgeable estate attorney can help make navigating. Generally the tax is a percentage of the value of the property being inherited. The size of the inheritance.

State inheritance tax rates range from 1 up to 16. Inheritance and Estate Taxes. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1.

The will must be filed with the circuit court in the county where the decedent lived. Petition for probate may be filed at the same time. Restaurants In Matthews Nc That Deliver.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in.

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

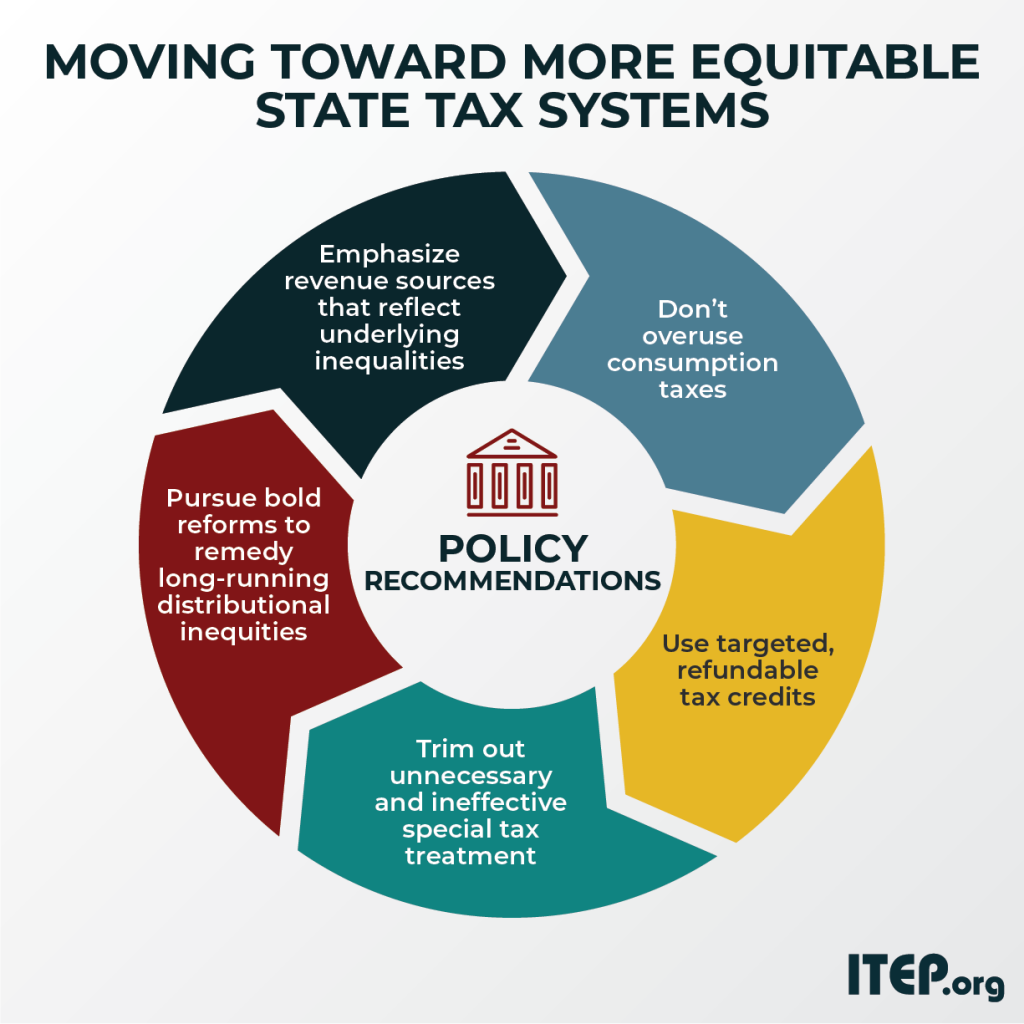

Moving Toward More Equitable State Tax Systems Itep

States With Highest And Lowest Sales Tax Rates

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Is There A Federal Inheritance Tax Legalzoom Com

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Here S Which States Collect Zero Estate Or Inheritance Taxes

Arkansas Inheritance Laws What You Should Know

Eight Things You Need To Know About The Death Tax Before You Die

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

Arkansas Estate Tax Everything You Need To Know Smartasset Estate Tax Estate Planning Inheritance Tax

Is There An Inheritance Tax In Arkansas

Get Our Example Of Small Business Security Plan Template For Free Startup Business Plan Template Business Plan Template Business Plan Template Free